The European Digital Identity Wallet: Onepoint at the forefront of the sovereign and secure digital revolution

The tools of identity digital are fundamental to improve social inclusion and economic of populations, and to provide access to services public and private services that are easily and quickly accessible to all and in a highly secure manner. National digital identity ecosystems vary from country to country, and from continent to continent, depending on a multitude of criteria cultural, technological and organizational.

The increase in these cyberthreats, remote work and digital transformation, e-commerce and online services, mobile and biometric technologies, consumer demand for seamless experiences, are the main drivers of the digital identity market.

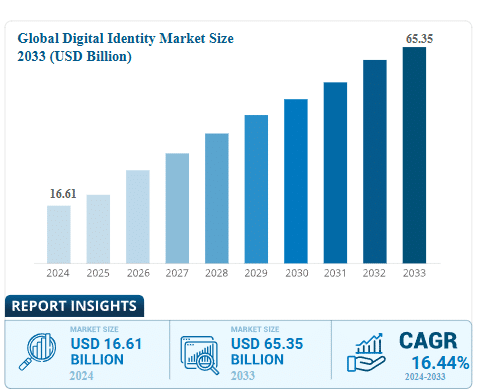

A growing market in a constantly evolving environment

In its latest study, Business Research Insight predicts that the global digital identity market size is expected to grow from USD 16.61 billion in 2024 to USD 65.35 billion in 2033, at a growth rate of over 16% per year.

In February 2025, the expert group on the wallet digital within the Mobey Forum concluded that the integration of digital identity into A2A wallets will enable additional use cases, such as the age verification for goods or services subject to restrictions. This integration allows also to streamline the onboarding (or KYC) of clients in loyalty programs or memberships, by reducing friction at the sign-up point and increasing conversion rates.

The Europeans have a digital identity standardized and secure to access online services

Digital transformation requires secure identification and authentication to access connected services, which becomes essential as technology evolves. Digital identity also allows citizens to control the dissemination of their personal data, thereby enhancing their autonomy in an increasingly complex digital environment. Today, the diversity of electronic identification systems within the Union European creates a fragmentation that makes it difficult for citizens and businesses to access online services.

This fragmentation also paves the way for cyberattacks orchestrated by all kinds of criminal organizations (identity theft, data theft, phishing scams, and fruof financial, etc).

Stronger authentication procedures are needed due to the increasing risks in cybersecurity which is one of the main driving factors behind the digital identity market. Passwords used in traditional methods are vulnerable to attacks particularly initiated by social engineering techniques. This can lead to illegal access to individuals’ or businesses’ accounts. Businesses and individuals use, increasingly, multifactor authentication systems to protect against these threats such as strong authentication (SCA Strong Customer Authentication) promoted by the DSP2.

The reasons for using digital identification solutions are numerous including better cost efficiency, a simplified user experience, and easier regulatory compliance. Additionally, there are online platforms that enable payment one-click a formidable weapon by combining identification and authentication or verification of identity attributes. Finally, penetration of mobile makes mobile applications an essential vector for spreading solutions digital identity. One remembers also that COVID-19 highlighted the importance of digital identity services for public services such as voting by mail or other administrative formalities remotely.

Today, social networks allow for rapid creation of digital identity, but this is not suitable for services requiring a high level of assurance. These online platforms are becoming also identity guardians. This raises then concerns regarding user data privacy and the market power of these platforms, which facilitate the integration of digital identities through social login solutions.

Naturally, governments and banks are starting to play a more significant role in providing these solutions as seen in Sweden with BankID.

A European initiative contributing to the sovereignty of the continent

The European initiative around the European digital identity wallet will strengthen the role of the European states on this issue of identity, which also relates to the sovereignty of each Estate.

The regulation eIDAS, adopted in 2014, aimed to harmonize electronic identification and trust services within the Union European, thus facilitating secure online transactions with levels of assurance classified as low, substantial, and high, representing both a challenge and an opportunity for the modernization of digital services.

The new regulation eIDAS 2, which comes into effect in May 2024, requires member states to provide digital identity wallets by the end of the yearned 2026 to their citizens.

Surveyed, users admit to encountering identification problems when purchasing items or renewing identity documents. Very often, they use copies or scans of official documents, which raises concerns about the security and reliability of information. Finally, Europeans believe that it is crucial to be able to use a solution sovereign European digital identity throughout the Union European, which highlights the required a united digital Europe.

With this European digital identity wallet, the user experience is facilitated regarding the management of multiple digital identities, which has become a true burden, who has never encountered difficulties during online transactions for due to password forgetfulness.

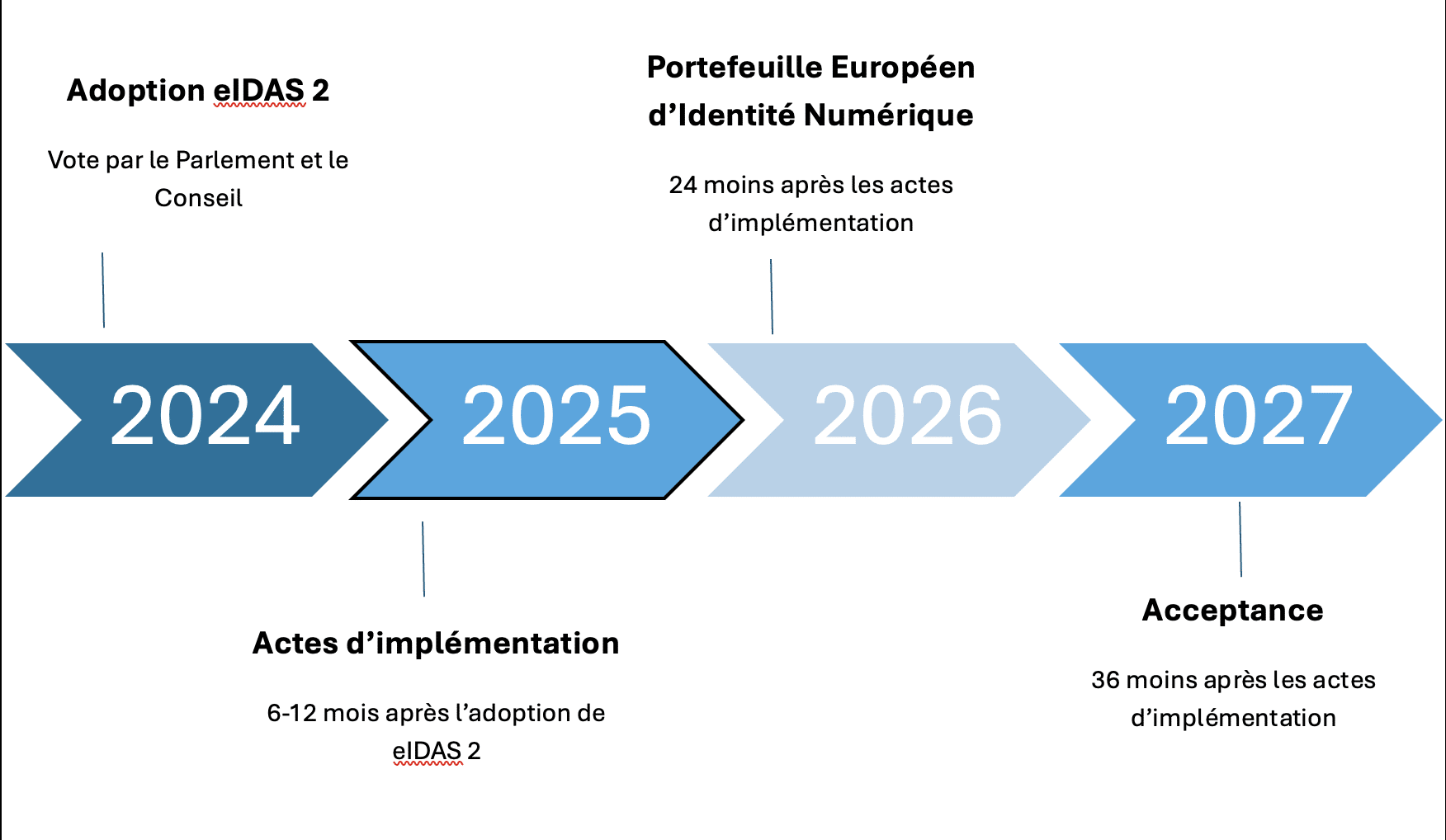

The European Commission has already set several critical milestones to implement the European Digital Identity Wallet (EDIW) or European Digital Identity Wallet (EUDIW).

The creation of this PEIN/EUDIW aims to ensure that citizens have complete control over their personal data, while ensuring their security when using these solutions of digital identity accessible through a mobile application.

The timeline for implementation established by eIDAS 2 is very ambitious to be at the meeting of 24 December 2026 for the availability of the portfolio by the Member States. The implementing regulations defining uniform standards and procedures have already been published at the end of December 2024, ensuring interoperability and security. The data is stored locally, and users control the information shared via ua privacy dashboard ensuring transparency. la transparence.

Another key deadline set for December 24, 2027: the use of the European digital identity wallet as a means of strong authentication. Specifically, bank customers will be able to use this wallet as an alternative to their digital key or other Secure Pass of their banking application to authenticate online payment transactions or any other process requiring strong authentication.

Some countries have not waited for these deadlines to offer a digital identity solution to their citizens. France, for example, offers the France Identité solution which provides all the guarantees required by the new regulation eIDAS 2.

Large-scale experiments

The creation of the European cooperation group European Digital Identity Cooperation Group (EDICG) is essential and will ensure the harmonization and security of digital identity solutions that will be proposed across the Union European.

Governments and stakeholders are collaborating now within Large Scale Pilots (LSP) orchestrated by four consortiums (Potential, EWC, Nobid and DC4EU) staff since 2022 to ensure the success of the European digital identity wallet.

Regarding the experiments conducted through these Consortiums, a new phase is opened to which Will not participate on the period 2025 -2027. Several use cases will be tested, particularly those related to the payment universe and banking services: opening bank accounts for individuals and businesses, authentication of payment transactions both C2B and B2B and B2G, particularly integrating the environment of electronic invoicing and digital receipts.

February 7, 2025, the consortium, Wallet Ecosystem for Business and Payments Use cases on Identification, Legal representation and Data sharing (WE BUILD) a has officially been selected by the Commission to participate in this second series of large-scale pilot projects for the EU digital identity wallet. WE BUILD will support this initiative by making considerable efforts to strengthen the European ecosystem of the digital identity wallet, through a use case-driven approach, including 13 use cases identified in the fields of business and payments, aimed at making life easier for businesses and individuals.

WE BUILD focuses on use cases with a high occurrence level and a high impact on the digital economy and with nearly 200 partners – member states, public and private sectors, large, medium, and small – WE BUILD has the breadth, depth, and power needed to make a significant impact

Onepoint co-lead the experiments on the subjects of « corporate payment » within the WEBUILD consortium.

Due to his expertise profession and technology, Onepoint is a stakeholder in the implementation of this European identity portfolio of digital identity, does not directly contributing to the WE consortium BUILD. Thus, Onepoint will bring its contribution to the elaboration framework ensuring interoperability and will help simplify access to services digital for citizens Europeans, thus strengthening digital inclusion. Combined with son payment expertise, Onepoint mobilizes expert communities around the user experience, architecture, cybersecurity in particular, to contribute to this large-scale European project.

Onepoint has the ability to address end-to-end issues related to digital identity and to support its clients across the entire value chain. Strategic issues of integration of this WALLET Identity to the definition of a forward-looking vision of identity, does not support all actors regardless of their maturity.

Onepoint is thus committed to giving meaning to the transformation dynamic and placing humans at its center, always in service of the performance and competitiveness of its clients.

Documents and references

European Digital Identity Wallet Website

European Digital Identity Framework

European Digital Identity Wallet – Fact page

France Identité | Prouver son identité en ligne et maîtriser la diffusion de ses données d’identité.

Digital Identity Market Size, Share & Forecast [2033]